By David George-Cosh @ BNN Bloomberg

With cannabis sales hitting new monthly highs, producers and retailers take advantage of cheaper prices

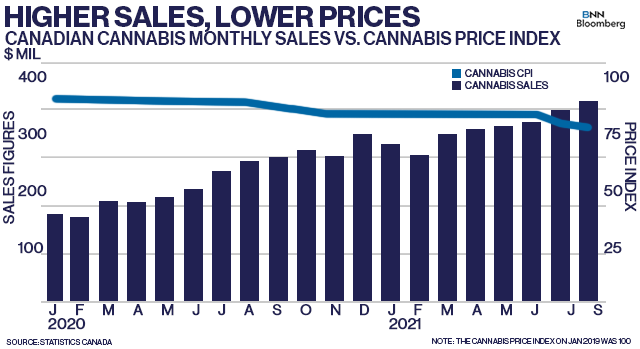

As the price of cannabis goes down in Canada, more of the stuff is being bought.

Statistics Canada said Friday that $356.9 million worth of cannabis was sold in August, a new monthly record and up 5.2 per cent from the prior year. On an annualized basis, cannabis sales are up 42 per cent despite signs of the pace of growth beginning to slow down.

Despite sales trending upward, the market itself is moving to sell as much of it as cheaply as possible.

A slew of various data reports show the price of legal cannabis has dropped considerably since it became legal in Canada. Cannabis Benchmarks’ spot price has fallen by about 37 per cent to $5.15 since January 2019, while the inflation figures show cannabis prices declined by 22.6 per cent since the end of 2018.

With the price of cannabis dropping, producers like Tilray Inc. and Hexo Corp. — which are able to cultivate cannabis at scale for as little as possible — have been able to take those production gains and translate them into leading market share positions, as they also approach profitability.

“With several companies likely not able to sustain these lower prices, given their cost structure and production inefficiencies, we would expect the lowest cost producers to gain share,” said Cantor Fitzgerald Analyst Pablo Zuanic.

The trend of lower prices has also resonated in the retail space. As retailers realize that the majority of cannabis consumers opt for price and convenience, they’re turning to the same discount model that the illicit market employs.

That strategy has led to the rise of Nova Cannabis’ Value Buds brand across Alberta and Ontario, where its stores sell about $3.1 million of cannabis annually, roughly one-third higher than the average store in the country. And as Nova looks to grow its network to more than 200 by 2023, it will have to compete with High Tide Inc., which announced this week it will aggresively move toward a discount model of its own with a loyalty program that will give its 245,000-strong members steep discounts on accessories and other products.

“We have specifically developed this retail concept to speak to the needs and preferences of today’s cannabis consumer, with a focus on value, quality, and an exclusive product portfolio,” said High Tide Chief Executive Officer Raj Grover, in a statement.

The sacrifice that High Tide will make on its margins, estimated to be around 10 per cent, will be offset by higher sales volumes, according to John Chu, an analyst at Desjardins Capital Markets.

Despite the glut of cheap weed being sold across the country, the illicit market continues to linger. The Ontario Cannabis Store (OCS) said this week that illicit sales were estimated to still account for a slight majority of the market (52.9 per cent versus 47.1 per cent).

Chu said in a report to clients on Friday that the OCS continues to expect prices to broadly move lower both online and in retail, which should help draw more illicit users into the legal market.