- Printed profitable per share for first time.

- Doubling store count and revenue with recent acquisition, and this will likely double earnings in the very near future.

- Stated goal of doubling store count after acquisition over period of time and will continue to increase shareholder value.

- Stock price is significantly undervalued.

The beauty of the cannabis industry is that it is still fairly new while at the same time stocks are near all-time lows. When I analyze a company, there are a couple of variables that I look for in a cannabis industry participant. First, I take a broad look at the cannabis industry to see what the overall trends are. In Canada, cannabis is increasing every month more and more. Then I look at a company’s respective earnings. Since Canadian cannabis sales continue to rise, my expectation is that a company doing business up in Canada should have rising earnings. Next are costs; gross costs and operating costs. I want to see if management is focused on the basics. Earnings are next. Given this environment where we are seeing rising retail sales month after month, if costs are kept down, can a company achieve profitability. The final piece of the puzzle is how much the stock is trading at versus where I think it is trading. As I said, cannabis stocks are near lows since they’ve been beaten down so much. That is an opportunity, as far as I am concerned.

When I looked at the data and charts on High Tide (OTCQB:HITIF), for all of the right reasons, it was love at first sight. Here is a breakdown of this Canadian company and why I think it is going to be a great company for a long time.

High Tide is a retailer and producer of cannabis with several strong brands and is even partnered with Snoop. High Tide is in the process of acquiring Meta Growth (OTCPK:NACNF) which overwhelmingly voted to be picked up by the larger company. The combination of the two will create the biggest cannabis retailer in Canada with 63 stores and plans to double that over the course of the next year. That is a very valuable place to be in with a budding industry. It should be noted that High Tide has prominent investors in its own operations from both Aurora Cannabis (NYSE:ACB) and Aphria (NASDAQ:APHA); the latter of which is being merged with Tliray (NASDAQ:TLRY). High Tide is also on its way to NASDAQ, which will increase its credibility as well as liquidity.

As the fundamentals show, there are a lot of positive aspects of the company. But first, let’s check out the new data coming out of Canada.

Cannabis in Canada

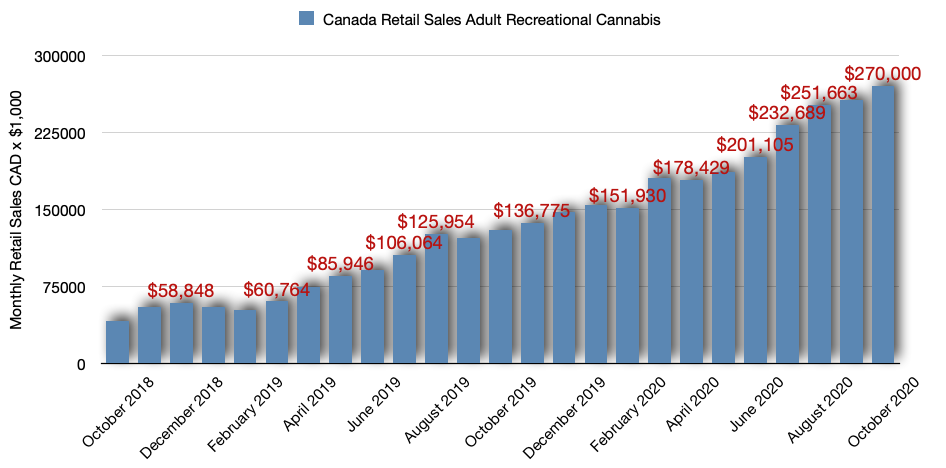

One of the things that I always keep an eye on is the cannabis industry’s overall sales numbers. As it turns out, Canadians are purchasing more and more and more cannabis. The recent data was just released and the 12-month increase is well over double, moving from $125M in October 2019 to $270M today, ~110% increase YoY:

(Data Source: StatCan)

There are 25 data points on the chart above. Five of them are downward on a MoM basis; the rest have moved upwards. Keep in mind, the YoY is during a global pandemic so the increase is a bit more meritorious. One of the reasons is that cannabis in Canada is legal on the federal level. Because of that, a person can purchase their products and have them delivered to their door through the mail.

I do not see the rate of growth abating too much anytime soon. Continuously, I see the number of dispensaries opening increasing. Access to dispensaries is a strong indicator of sales. So, as the numbers increase for dispensaries, Canadian retail sales of cannabis increases.

Revenue

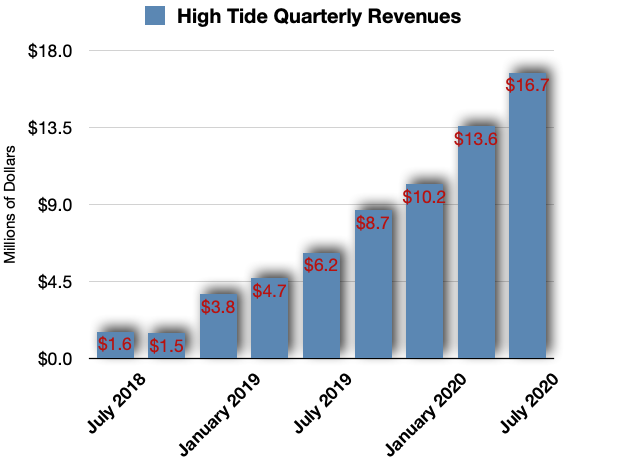

As I mentioned, once you’ve looked at the overall industry, the next box to check would be the increasing revenues box. Keep in mind, High Tide is putting together the country’s largest network of retail dispensaries which is key to sales. Here is the result of the continued increases in dispensaries that High Tide has already put in its portfolio:

(Data Source: High Tide – Author’s Chart)

YoY, High Tide went from $6.2M to $16.2M, a nearly 200% increase in revenues. After checking with SEDAR, Meta Growth has reported revenues of ~$12M over the summer, so we can expect that this number will increase by almost double once the company reports combined earnings.

Right from the start, looking at the data for what the combined company can print, it is an upwardly increasing revenue stream. Granted, I believe there will be some point where the revenue starts to level off, or at the very least tapering its growth rate. But I do not see the current growth rate abating any time soon.

Gross Margins and Operational Efficiencies

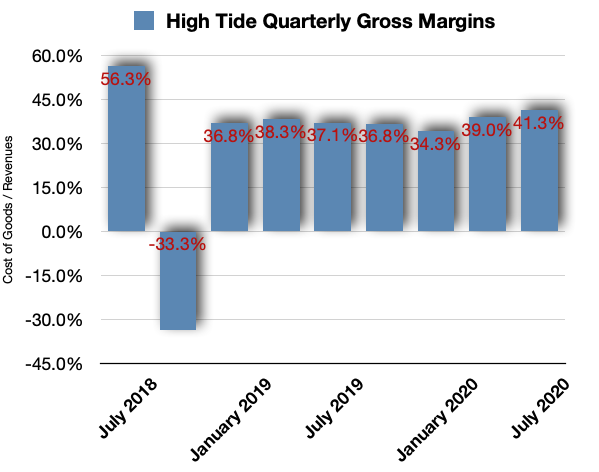

I am a big stickler when it comes to management keeping costs in line. But, with cannabis companies, since they are all still relatively new, costs tend to be all over the map with the companies I’ve looked at. But, as I mentioned earlier, this company checks all of my boxes, and here are gross margins to show what I am talking about:

(Data Source: High Tide – Author’s Chart)

Consistency is one of the variables you are looking for so that management knows what it is working with. These numbers are highly consistent. This helps with management’s decisions because it generally knows where costs are going to come in. At the same time, High Tide has a large retail presence. Margins from products at a retail establishment are fairly consistent.

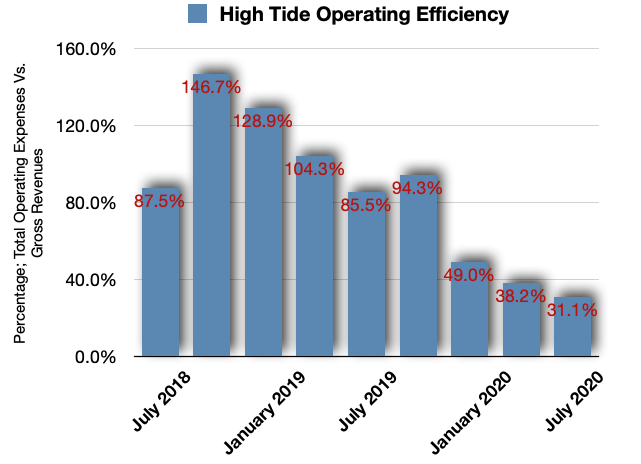

Operating efficiencies are another important indicator and High Tide is moving in the correct direction:

(Data Source: High Tide – Author’s Chart)

If gross margins are 41.3% and operating expenses are coming in at 31.1%, then management has a solid chance at profitability. Should the operating efficiencies improve from here, then earnings will do the same. The downward slide is impressive in the sense that it is persistent.

The combination of the two future companies merged together may improve margins even more, which will be an even larger benefit than where the company stands at this point. Keep in mind, when you merge two retail companies, you can then offer different products at an existing store and thereby improve the potential revenue on a same-store basis.

Net Income

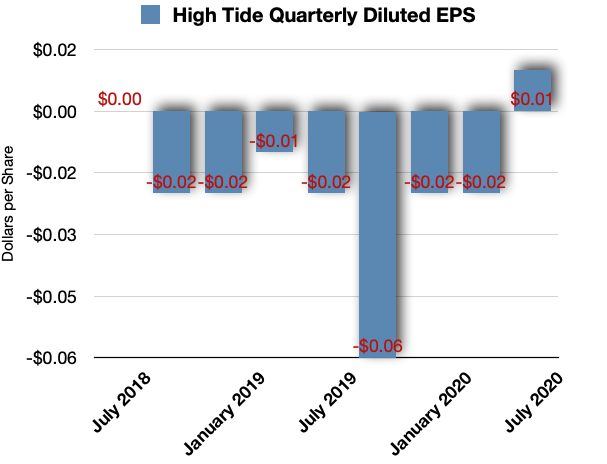

As I had previously mentioned, net incomes were positive. With gross margins remaining consistent and operating efficiencies continually declining, it seemed to be a matter of when the company would print positive net income:

(Data Source: High Tide – Author’s Chart)

Now that the company has printed positive earnings, and with an even bigger revenue base to work with, we can start valuing this company on a future earnings potential.

However, I do want to point out that the SEDAR information I found on Meta Growth shows the past-three month earnings to be a loss of -C$23M for the quarter whereas High Tide printed a profit of C$4M. This will be the next step for the combined company to get to that point where there is a joint profit. Having the biggest cannabis retail presence in Canada is a great statistic to brag about. But, if it does not earn a profit, what good is it.

Having said that, High Tide has proven what management is capable of accomplishing. It certainly has a strong mix of brands to offer customers who are continuously shopping at its stores or High Tide would not have been able to print a profit. That is the template that I believe will be used to work with the new mix of stores. Because of this, I believe that getting the combined companies to profitability will be a lot quicker than what High Tide already accomplished alone.

While this may keep the stock price at bay, it is just a matter of time until I believe the stock will begin an appreciable rise upwards.

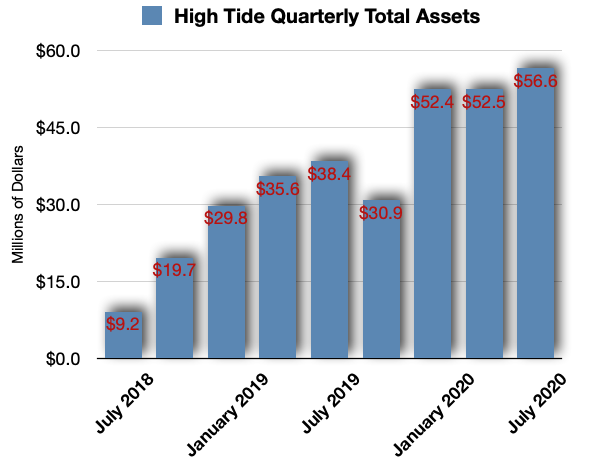

Equity and Book Value

What is a company worth? There are two places to look for a company’s valuation when you want to know what they are worth. Value investors most certainly look at book value to see what assets the company has built up. Here are High Tide’s total assets:

(Data Source: High Tide – Author’s Chart)

One of management’s jobs is to continually increase value in a company. And this is what a value investor is looking for. I am a value investor at my core. This chart is continually rising and so that is a good thing. But there are two sides to the equation and liabilities are on the other side.

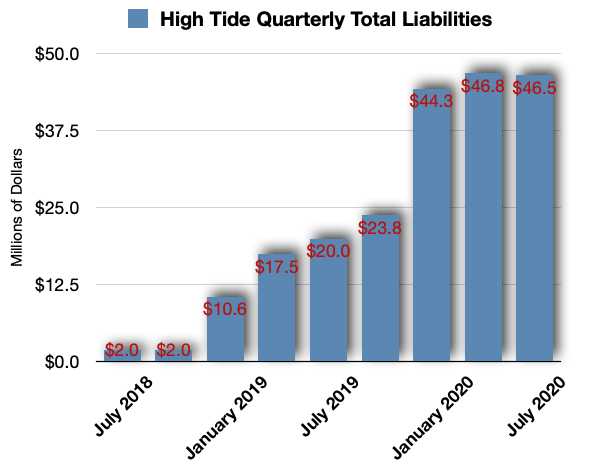

Just as assets have been increasing, so have liabilities:

(Data Source: High Tide – Author’s Chart)

This is by no means a bad thing. In order to create an omelet, you have to crack some eggs. And taking on debt is part of the process of building a business. This difference is about $10M and this is moving higher.

I use these metrics for two reasons. First, it establishes the basis for “what is my worst-case scenario?” If things go south by a long shot if the company were to be liquidated, what would there be? This concept of book value and assets helps to establish that metric, but it is by no means a panacea. But it allows me to look at a company and see if there is value there that the stock market is not pricing in.

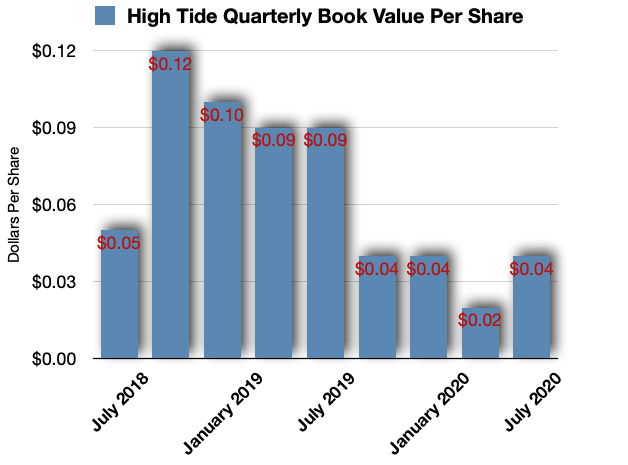

Book value per share is a function of total assets, and you can see the book value here:

(Data Source: High Tide – Author’s Chart)

As it turns out, it is low compared to the stock price. So, you need to consider the forward earnings as well in the equation with valuing High Tide… up to a certain point. Let me explain.

First, forward earnings, should they be consistent with the numbers right here at $0.01 per share, with no increases in earnings – more on that in a moment – then High Tide would earn $0.04 per share. With 30x earnings multiple, that puts the company’s stock potential at $1.20. Nice. But wait.

High Tide is also taking on a losing company. True, revenues will nearly double. To me, that is huge. If you have two stores in different parts of a city, they each sell about the same amount of product but one is profitable and the other is not, bringing in the new management from the profitable company to teach the other unprofitable company how to be profitable should not be the world’s tallest mountain to climb. That to me is the opportunity.

So, High Tide is taking on a company that would significantly alter any future valuation models. I am not interested in getting into a stock that might be priced too high, but with this, there is still room. But, if you visualize forward, you can see a lot of potential.

I believe that the stock, albeit higher than book value, is still significantly below the future earnings multiples traditionally applied to growth stocks.

HITIF Stock

HITIF stock may be above book value, but it is well below where it could be when you consider future earnings multiples:

(Chart Source: Trading View)

I find this time and time again in the cannabis industry. And I can’t tell you how much I love to find stocks that are below value. Again, given the current multiples on future earnings, HITIF would be about $1.20 per share, and that is easy mathematics. But, as I mentioned, it is taking on a company that will bring this valuation back down, and this would devalue the stock.

But then you start to consider the new valuation of the company. Given revenues that will immediately double on a per quarter basis, and given the company wants to double the number of stores, wouldn’t the stock’s valuation be multiples higher given these variables?

Where will High Tide be in one year’s time?

High Tide has just become a profitable company with $0.01 per share revenue. I believe that number would continue higher after a year’s time. But we do not need to speculate on that just yet. Earnings and future valuation would put the company’s stock at $1.20 per share today.

Then, High Tide is going to double its revenues with the recent acquisition of Meta Growth. Given the success that High Tide has had with its own retails stores, I believe that the newly acquired retail stores will see the same earnings. Given that, the future multiple pushes the stock upwards to $2.40 per share.

But the stated goal is for High Tide and Meta Growth to also double their own store count over the next couple of years. That is a huge leap forward for the combined companies. Nonetheless, I am looking at what management is doing with its costs and I believe it is well disciplined and mindful of its responsibility to provide value. So, I believe that if they were to open a new store up this discipline and mindfulness would be employed in a structured manner with any new store opening.

Given this potential, when the store count does reach the 113 level it has declared, that would put the per-share earnings at about $0.04. With 30x earnings multiple, this puts the stock at $4.80 per share in a period of time that it would take to get these new stores to profitability.

The Takeaway: Is High Tide A Good Buy?

It is going to take time and investment for High Tide to be able to hit its numbers for opening new stores. The pace it has declared is blistering and I have a tough time believing it can be done prudently. But prudence is the one thing High Tide has demonstrated it is committed to. Still, convincing the neighborhood to consistently shop at a new store takes time, no matter how good management is. I think High Tide will get to its stated goal of profitability with the newly merged company and that should occur in one year’s time. I also believe that it will open significantly more stores as it is projecting to do, and these new stores will likely be profitable in some period of time, but I do not believe that is possible within one year’s time.

Given that, I believe that this company will be a big winner at some point in a couple of year’s time. I am willing to be very patient in my outlook as to when these goals are achieved.

I am very bullish on High Tide.

Written by: D. H. Taylor

Source: Seeking Alpha